A Small Business Restructuring Plan Could Save Your Business

Find out how a Small Business Restructure could be the answer to your financial problems

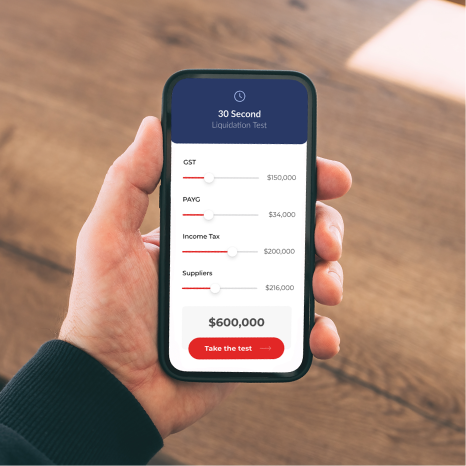

Take The 30 Second Test TodayCall Today: 1300 452 109

Relief for small businesses from over $15.4M of insurmountable debt

Opt for a Small Business Restructure Plan and steer your business towards recovery within just 36 business days

100%

of Plans Approved*

78%

Avg. Debt Reduction*

$326,115

Avg. Savings of Clients during 2023*

*Data is from SBRs we completed in 2023 and is accurate at distribution and indicative only. Actual results may vary. No future outcomes are guaranteed.

What is Small Business Restructuring?

If you have a small business in financial distress, a Small Business Restructure can help alleviate the pressure surrounding business debts. Your company works with one of our registered Small Business Restructuring Practitioners (SBRPs) to negotiate payments of historical debts with your creditors, so as to better your chances of business survival. The process takes a little over a month, and gives you more certainty about your company’s future.

How it works

If you have an eligible small business in financial distress, a Small Business Restructure (SBR) offers an option for you to renegotiate your historical business debts with creditors, when those debts are restricting your ability to effectively trade.

As part of the SBR, a compromise is made between the creditors and your company, which involves you agreeing to pay back your debt to the creditor, in part or in full, over a defined period. If you and the creditor agree that you only need to pay your debt in part, the remaining debt is written off.

During this process, the directors and management of your company remain in control of daily operations. The Small Business Restructure process is completed within approximately 36 business days.

Understanding Small Business Restructuring

Small Business Restructuring (SBR) emerged during the pandemic to help otherwise viable businesses deal with financial problems restricting their ability to trade successfully, offering a pathway to renegotiate debts significantly with creditors. The Small Business Restructure process is supported by the government (see Sept 2020 Treasury press release).

Key Benefits of a Small Business Restructure

If your company’s in financial distress, a Small Business Restructure through Business Rescue Solutions offers:

- An honest assessment of whether or not your business can be rescued.

- Reduction of debt, via compromises with creditors, and ATO tax relief.

- A map for future business success, rather than focusing on past problems.

- A fast turnaround for a resolution (with Business Rescue Solutions, you can expect an SBR resolution within 36 business days).

- A fixed price for SBR services – no hidden surprises.

- The ability to remain in control of the day-to-day operations during the SBR process.

Is my business eligible?

Check your eligibility for Small Business Restructuring today. Take our short eligibility test

Timeframes for Small Business Restructure

Implement the SBR process in just 36 business days. Appoint a Licenced Practitioner to create a restructure plan for approval by the ATO and other creditors, reducing debts and mapping a route to success.

Small Business Restructure Outcomes

Below shows the average small business restructuring outcomes we have achieved.

Before SBR

High debt levels and insufficient assets

$416,116 Average Debt

Case Studies

CONSTRUCTION

CONSTRUCTION

$380,000 Debt

$75,000 Debt

80%

Debt Reduction

SBR

-

Before SBR

$380,000 Debt

$75,000 Debt After SBR

Debt Reduction

80%

Our client operated in the production and installation of steel frames in Victoria. A director of the business attributed the failure of the business to the global steel shortage, the increase in costs of materials and the level of fixed costs, during a period of reduction in revenue (all factors largely arising out of COVID-19).

The business held cash at bank, vehicles, debtors and retentions at the date of the appointment, none of which were available under the restructuring plan.

Following the process, the Director was able to carry on the business without the significant debt levels and without the cost or burden of the business being placed into Voluntary Administration to reach the same outcome.

HOSPITALITY

HOSPITALITY

$260,228 Debt

$48,250 Debt

81%

Debt Reduction

SBR

-

Before SBR

$260,228 Debt

$48,250 Debt After SBR

Debt Reduction

81%

Our client was a cafe operating in regional Victoria with 22 employees. It suffered financially from the Victorian State Government lockdowns during the COVID Pandemic with a significant reduction in sales with little or no reduction in fixed costs.

The cafe was a profitable business before lockdowns and has since returned to trading priofitably, but the debt incurred during the COVID Pandemic threatened the business.

Following the process, the director could carry on the business without the significant debt levels and without the cost or burden of the business being placed into Voluntary Administration to reach the same outcome.

A Summary of Some of Our SBRs

| Industry | Debt before SBR | Debt after SBR | % Debt Reduced | % Return to Creditors |

|---|---|---|---|---|

| Construction | $380,000 | $75,000 | 80.26% | 18.95% |

| Engineering | $542,000 | $100,000 | 81.55% | 18.50% |

| Hospitality - Hotel | $425,000 | $75,000 | 82.35% | 17.62% |

| Transport | $450,000 | $73,000 | 83.78% | 16.18% |

SBR Rescue & Recovery Cycle

Eligibility

Take the 30 second test and participate in a pre-appointment consultation

Appoint an

SBR Expert

Our expert will help you and we will create a plan of action for your business

Develop SBR

Rescue Plan

78% Average Debt Reduction*

Creditors

vote on Plan

$326,115 Average Debt Forgiven by Creditors*

Business

Saved

100% of Plans

Approved*

*Data is from SBRs we completed in 2023 and is accurate at distribution and indicative only. Actual results may vary. No future outcomes are guaranteed.

Helping to Support Government Policy.

Michael Sukkar, the Assistant Treasurer of Australia in 2020, has been instrumental in implementing significant reforms to Australia’s insolvency framework. These reforms aim to support small businesses during challenging economic times, particularly in the aftermath of the COVID-19 pandemic.

92% of restructuring plans since 2021 have been accepted.

See the ATO’s position around SBR.

The Hon Michael Sukkar MP

Minister for Housing and Assistant Treasurer

Our National Team

Frequently Asked Questions

A Small Business Restructure provides companies in financial distress with breathing space to develop a plan that will provide for the continuation of their business, and a better return for their creditors (compared to a hypothetical liquidation scenario).

In an SBR, a Restructure Practitioner assists the company to negotiate a plan with creditors to pay their historical debts.

The benefits of an SBR are, in brief:

- Directors stay in control of day-to-day runnings of the business during the SBR process.

- Companies receive a fresh start to resolve historical debts.

- There’s a temporary moratorium on unsecured creditors enforcing debt repayment (including personal guarantees) during the restructuring phase.

- The restructuring process takes a relatively short time.

- There’s certainty of costs (SBR is a fixed-price engagement).

- The government has a positive attitude towards the SBR process.

Commonly, the most prominent warning sign your business is in financial distress is a large unpaid tax debt. Other signs can include ongoing losses, cash flow problems, overdue tax lodgements and difficulty gaining access to new credit. These signs all indicate that it would be beneficial to consult with Business Rescue Solutions about a Small Business Restructure.

For a simple eligibility check, complete our 30 second eligibility questionnaire.

To be eligible for Small Business Restructuring, we check that your company fits the following eligibility on the day on which our restructuring practitioner is appointed:

- be insolvent or likely to become insolvent.

- total liabilities of your company must not exceed $1 million.

- no person who is a director of your company, or who has been a director of your company within the 12 months before the appointment of our restructuring practitioner, has been a director of another company that has been under restructuring or subject to the simplified liquidation process within the period of the preceding seven years, unless they are exempt under the regulations.

- your company must not have undergone restructuring or been the subject of a simplified liquidation process within the preceding seven years.

As part of the Small Business Restructure process, we also check that, at the time the restructuring plan is proposed to creditors, your company will have substantially complied with requirements relating to employee entitlement and tax filing obligations. A restructuring plan can’t be proposed until a small business has:

- paid the entitlements of employees that are due and payable (with the exclusion of employee entitlements not currently due to be paid).

- lodged returns, notices, statements, applications or other documents as required by taxation laws (within the meaning of the Income Tax Assessment Act 1997). [Tax debts do not need to be paid – only the required returns lodged.]

For full details on eligibility, see the ASIC website.

The Small Business Restructure process does not involve changes to how you run your business. Your company may, however, decide upon a number of other adjustments to your business to improve how it operates, including reducing costs, selling assets, changing its organisational structure, and so on.

The Small Business Restructure plan is to be presented to creditors within 20 days of the appointment of a Small Business Restructure Practitioner.

Creditors then have 15 days to respond to the plan, advising if they accept or decline the restructuring plan.

The entire process takes approximately 36 business days in total.

- We check to confirm your business meets the eligibility criteria for small business restructuring.

- Whilst the SBR is underway, the directors of the company continue to have control of ordinary business operations.

- We guide you to create a plan to pay historical debts to your creditors. This must be presented to creditors within 20 business days of the SBR commencing.

- We act as your company’s agent, negotiating a plan with your creditors to pay historical debts.

- The creditors decide (within 15 business days) whether or not to accept the plan.

- If creditors accept the plan, the company must make payment of the agreed sum in either instalments, or in a lump sum (as per the plan).

- After the payment is complete, the company is no longer liable to pay the balance of the debt, and it is considered “cleared”.

If the SBR plan is accepted, then it is binding on all unsecured creditors. This means that for the agreed timeframe of the plan, creditors who agreed to the arrangement can’t launch any other enforcement action relating to the recovery of debt or the winding up of the company. The result of this is that businesses can continue to operate during this agreed time period without the worry of court proceedings related to the debts subject to restructuring under the SBR plan.

An SBR will be considered terminated in any of the following circumstances:

- A court orders its termination.

- The company discharges its obligations required under the plan.

- The plan is not adhered to, and this contravention hasn’t been rectified within 30 days.

- A liquidator or voluntary administrator is appointed to wind up the company.

Testimonials we're proud of

Discover our exceptional testimonials, reflecting our commitment to small business restructure

Start Your 30 Second Eligibility Test

Check if your company is eligible for restructuring in 60 seconds